版权所有 © 2018 山东中灿 ICP备案号:鲁ICP备16001552号-1 网站建设:中企动力 济南二分

ABOUT US

Tel: 0086-538-6315517

Fax: 0086-538-6315510

Phone:0086-15588577955

Adress:Hi-Tech Development Zone,

Feicheng,Taian,Shandong ,China.

E-mail:ella@zhongcansteel.com

PRODUCTS

websites

0086-538-6315517

Service Hotline

Are steel prices trending up?

After declining for much of 2019, steel prices moved up substantially in the last two months of the year. What will be the trend heading into early 2020?

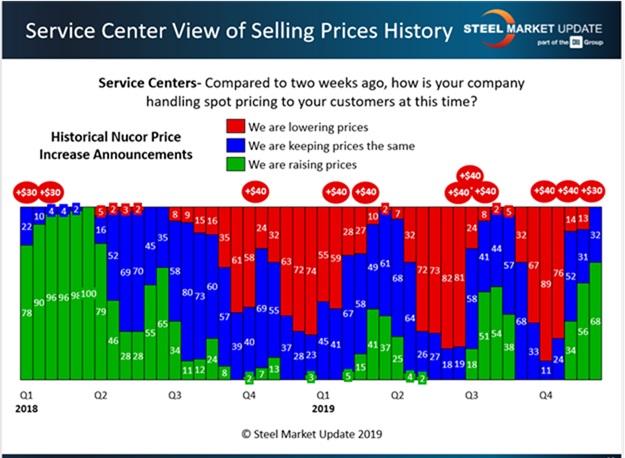

Flat-rolled steel producers raised prices three times during October and November for a total of $110/ton. Likewise, plate producers also announced three increases, raising prices by a total of $130/ton. The announcement of higher prices, however, does not mean the mills will be able to collect them. That depends on what the market will bear and how much support they get from distributors (see Figure 1). But without doubt, the increases have moved the market.

Steel prices increased by approximately 20% from late October to mid-December. Steel Market Update (SMU) survey data as of Dec. 10 showed that the benchmark price for hot-rolled steel rose by nearly $100 to an average of $570/ton ($28.50/cwt) FOB mill, east of the Rockies. Cold-rolled and galvanized steels averaged $760/ton ($38.00/cwt), with Galvalume® at $770/ton ($38.50/cwt). The price of steel plate was up to an average of $690/ton ($34.50/cwt), from $640/ton at the beginning of November.

Steel buyers surveyed by SMU in early December were almost evenly split on the staying power of the recent price hikes. A slight majority (52%) said they expected to see prices stall and begin to move lower in the coming six to 10 weeks.

Ultimately, mills can collect higher prices over the long term only if there is sufficient demand (see Figure 2). Most buyers (56%) were reporting flat or stable demand last month. Another 34% saw demand declining. Only 10% said demand from their customers was improving, which may not bode well for those hoping for higher steel prices in the first quarter.

Steel buyers, including service centers and manufacturers, remained relatively upbeat, however, as the year came to a close. SMU’s Steel Buyers Sentiment Index trended up right along with steel prices in the last two months of the year (see Figure 3). The goal of the index is to measure how buyers and sellers of steel feel about their company's ability to be successful today and three to six months into the future. The Current Sentiment reading of +46 in early December was a 20-point improvement from early October. The Future Sentiment reading showed buyers even a bit more optimistic about the next few months with a reading of +52 (see Figure 4). Although improved, these sentiment readings are still well below levels at this time last year.

In Other News

Scrap prices climb. Ferrous scrap prices increased by $45/ton to $60/ton in November and December. There are a few reasons for that.

Demand remained solid as the mills continued to crank out steel at around 80% of capacity. Scrap supplies tightened as winter weather began to impede scrap flows into dealers’ yards. And a pickup in foreign demand for U.S. scrap boosted exports to countries such as Turkey, further tightening supplies here at home.

Higher costs for scrap and other raw materials help the mills justify higher finished steel prices. Experts anticipate even higher scrap prices in the first quarter.

“There is little doubt the U.S. scrap markets will rise again in January,” one executive told SMU. “January has nowhere to go but up, whether it’s from demand/supply, bad weather, or an export-driven scenario. It’s going to go up!”